Rental property depreciation calculator excel

HTL missed on both the top and bottom line. Depreciation formulas and Excel equivalent functions.

Rental Income And Expense Worksheet Propertymanagement Com

For some guidance on what goes into the calculations I consulted Vincentric a research firm in Bingham Farms Mich.

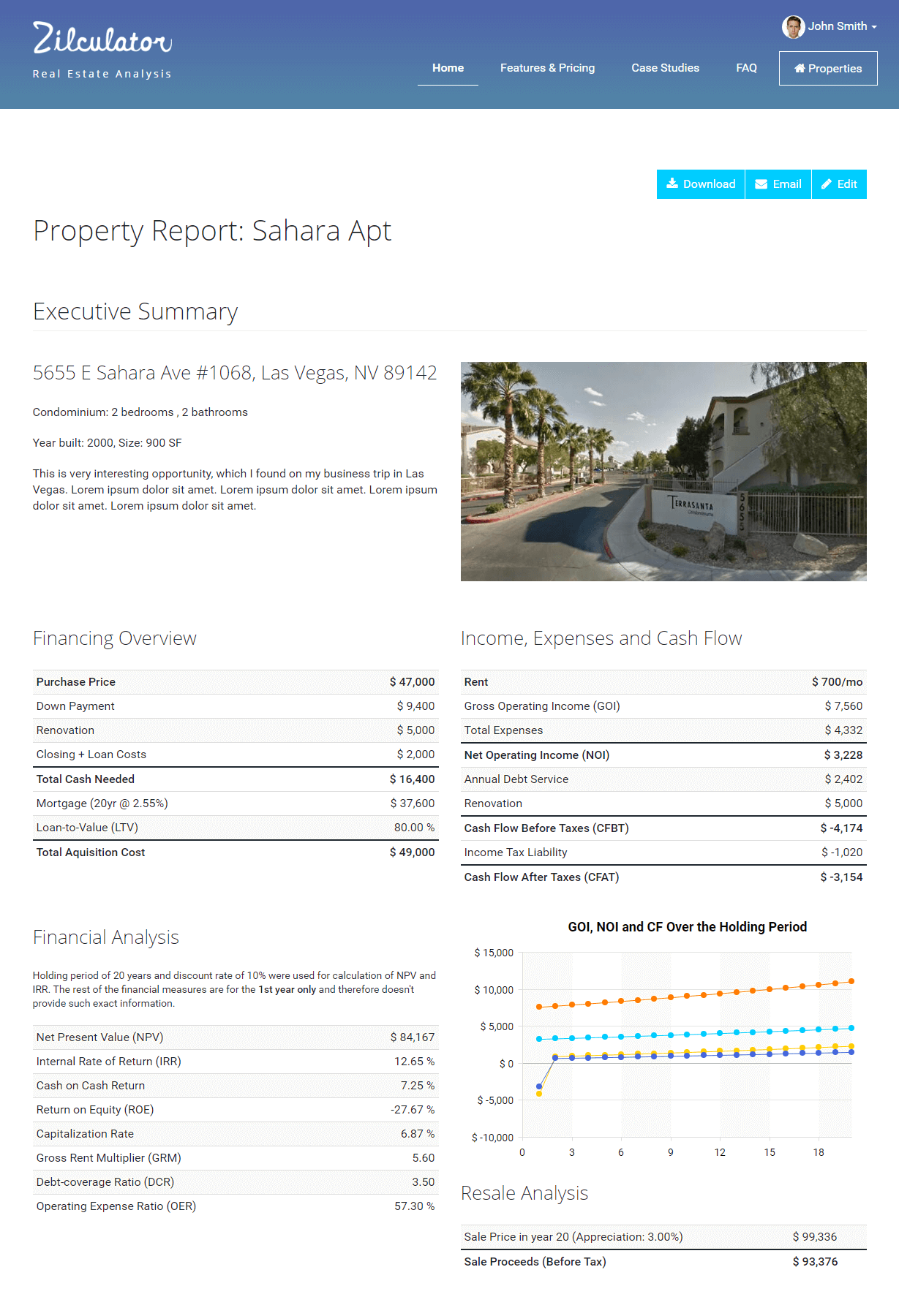

. The gross rent multiplier GRM approach values a rental property based on the amount of rent an investor can collect each year. Web-Based Rental Software Web BRRRR Calculator. Calculate depreciation and create depreciation schedules.

It is a quick and easy way to measure whether a property is worth. This page is the first of a 3-part series covering Depreciation in Excel. You can put all of your assets that have different purchasing dates and usage period within one table.

Lets say that the original depreciable value of a rental property was 100000 and the investor owned the property for 30 years and all the depreciation 100000 has been used or taken. Own rental property receive variable income have earnings reported on IRS Form 1099 or income that cannot otherwise be verified by an independent knowledgeable source. 8 AM to 5 PM Sat - Sun.

Includes online calculators for activity declining balance double declining balance straight line sum of years digits units of production real estate property and variable declining balance depreciation. Assessor of Oklahoma County Government Larry Stein. You are being redirected to a page hosted by Just Appraised Incorporated.

The Online Filing Portal is designed with your safety and convenience in mind. General Depreciation System - GDS. Revenues of 320K fell below consensus of 000000.

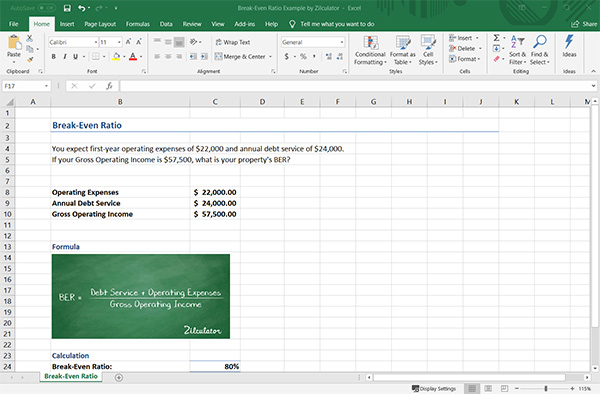

2 examine your serviceability and predict when you can afford the next property. This is why many people hire finance representatives or attorneys to deal with their finances loan mortgages interests extra payments etcFor example if you buy a house on a loan you will have to prepare a loan amortization tableBut do you really know the. Capital improvements repairs to calculate your total cost basis for depreciation.

In accountancy depreciation refers to two aspects a decrease in the value of the assets and allocation of the cost of assets to the useful life of the assets. We would like to show you a. It should ease you on getting the values to be put on respective journals and reports.

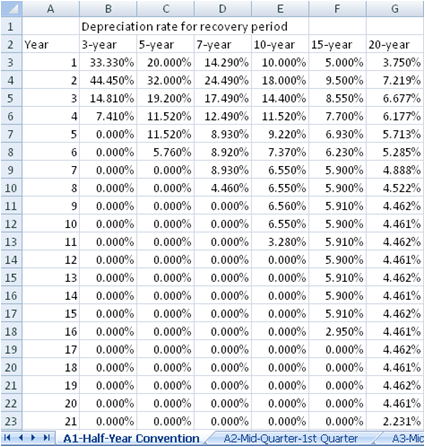

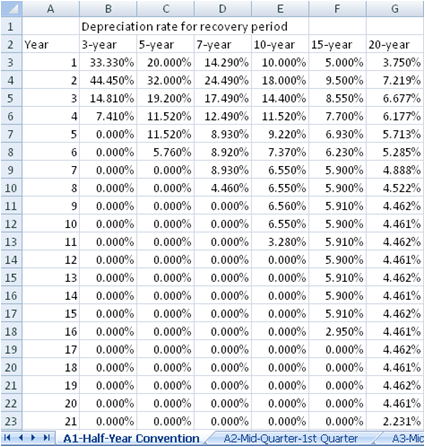

Business Valuation Resources recently published EBITDA multiples by industry from a study of over 30000 sold private companies listed in the DealStats database. Under Companies Act 2013 The depreciation is calculated on the basis of the useful life of assets and not on the basis of the rate of depreciation. Part 2 discusses how to calculate the MACRS depreciation Rate using Excel formulas.

Part 3 provides a Depreciation Calculator that can be used to. You can deduct the actual expenses of operating the vehicle including gasoline oil insurance car registration repairs maintenance and depreciation or lease payments. For complete Essent underwriting guidelines go to essentus.

This NPV IRR calculator is for those analyzing capital investment decisions. Commission Paid to Broker Commission paid to property broker. Selling price divided by EBITDA earnings before interest taxes depreciation and amortization is a commonly used valuation multiple.

The Ultimate Investment Property Calculator is a super model that many property investors dream. Rental Property Spreadsheets for analyzing rental deals managing rental properties. Business Hours Mon - Fri.

Vincentric specializes in calculating cost of ownership for vehicles and tracks more than 2000 models. But unlike a bald fade a high taper fade haircut doesnt cut down to the skin and instead levels off at very short hair. Finance has always been a bit technical for all individuals except the ones who have studied finance.

The most commonly used modified accelerated cost recovery system MACRS for calculating depreciation. 3 work out your expected income tax liability from year to. EPS of -0193 missed the consensus estimate of -0180-556.

The recovery period varies as per the method of computing depreciation. It is 275 for residential rental property under the General Depreciation System and 30 or 40 years under the Alternative Depreciation System. SAC Service Accounting Code for rental leasing falls under heading 9972.

Cash Flow Analysis CalculatorL37 Excel 97-2003. The domain fmoviestocc uses a Commercial suffix and its servers are located in NA with the IP number 104212346 and it is a cc domain. High Taper Fade The high taper fade is a professional look that gradually gets shorter as it moves down the side of the head.

The first step is to enter the numbers and their corresponding headings in the. There is a formula to calculate depreciation of your company assets automatically. Part 1 provides a Depreciation Schedule for financial reporting and explains the formulas used for the basic common depreciation methods.

For the 2021 tax year that rate is. For rental or leasing services involving own or leased residential property fall under SAC code 997211. In the process I created an Excel spreadsheet to help me analyze the long term cost of owning different cars.

Bobcat 753 traction lock solenoid location. This makes high tapered hairstyles classy and clean for all guys. A general depreciation system uses the declining-balance.

Or you can use the standard IRS mileage deduction. 1 predict how a portfolio of multiple properties up to 16 properties will grow in value. Ultimate Investment Property Calculator.

To calculate the depreciation value Excel has built-in functions. Depreciation will auto calculate and populate the form. According to the IRS the depreciation rate is 3636 each year.

Net present valueNPV and internal rate of returnIRR are two closely related finance calculations that are used by all types of businesses to make capital projections and to decide how to allocate capital between competing investments or expenditures. Provided by Alexa ranking fmoviestocc has ranked NA in NA and 3201411 on the worldfmoviestocc reaches roughly 969 users per day and delivers about 29078 users each month. Is a trusted contract vendor who assisted with the development of Oklahoma Countys new Online Filing Portal.

How To Depreciate A Rental Property Formula Excel Example Zilculator Real Estate Analysis Marketing

Residential Rental Property Depreciation Calculation Depreciation Guru

Depreciation Schedule Formula And Calculator Excel Template

Depreciation Schedule Template For Straight Line And Declining Balance

Investment Property Analyzer Rental Property Calculator Etsy Canada

Accumulated Depreciation Calculator Download Free Excel Template

I Put Together A Spreadsheet For Evaluating Rental Properties Would Love Some Feedback R Realestateinvesting

Macrs Depreciation Calculator With Formula Nerd Counter

How To Depreciate A Rental Property Formula Excel Example Zilculator Real Estate Analysis Marketing

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

How To Depreciate A Rental Property Formula Excel Example Zilculator Real Estate Analysis Marketing

Free Modified Accelerated Cost Recovery System Macrs Depreciation

Free Macrs Depreciation Calculator For Excel

Free Modified Accelerated Cost Recovery System Macrs Depreciation

How To Prepare Depreciation Schedule In Excel Youtube

Residential Rental Property Depreciation Calculation Depreciation Guru

How To Prepare Depreciation Schedule In Excel Youtube